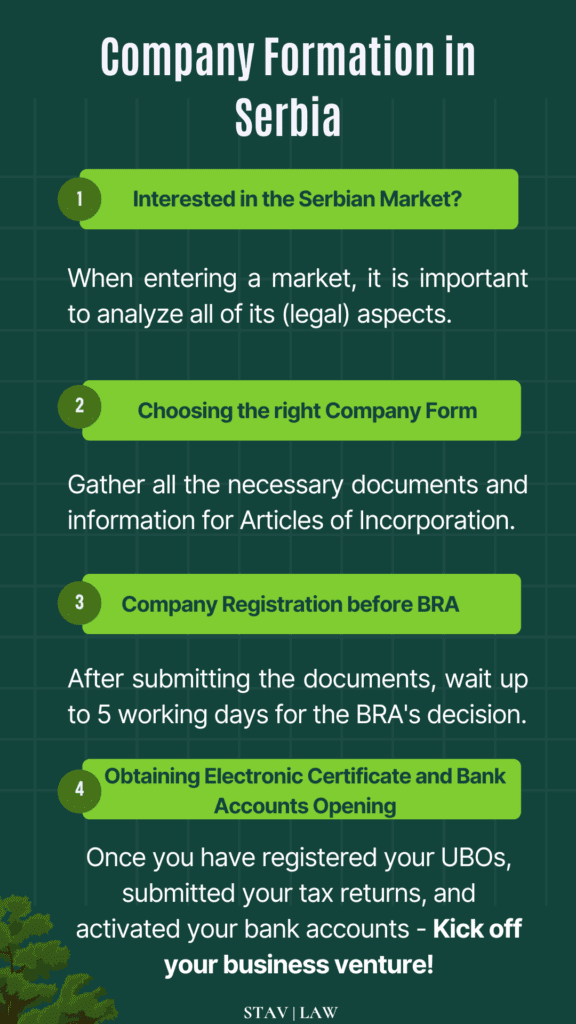

Everything starts with an interest – so how does company formation in Serbia work?

Are you considering entering the Serbian market and wondering how to start a business in Serbia? Company formation in Serbia can be a highly rewarding move for entrepreneurs looking to expand into new markets. Serbia offers numerous advantages, including favorable tax rates, and a strategic location in the Balkans at the heart of Europe! Serbia is also a growing market with numerous free trade agreements and a well-educated workforce, particularly in the IT sector.

Whether you wish to relocate your existing business and workforce to Serbia, or you’re looking to kick off a new business venture, this Comprehensive Guide to Company Formation in Serbia might be just what you need!

In this guide, we will walk you through the steps to establish a company in Serbia, from the initial idea to the successful company formation in Serbia.

- Legal Forms in Serbia and Their Differences – First Step in Company Formation in Serbia

- How Long Does It Take to Register a Company in Serbia?

- Choosing a Business Name Before Company Formation in Serbia

- Defining the Business Activity for the Company Formation in Serbia

- Management and Ownership Structure for Company Formation in Serbia

- Can Foreigners Be Founders and Directors of a Serbian Company?

- Do I Need to Have at Least One Director, Representative, or Founder Who Is a Domestic Citizen for Company Formation in Serbia?

- Do I Have to Employ a Director of the Company, or Is There an Alternative Option?

- Can I Restrict the Authority of the Director to Represent the Company?

- Company Headquarters and Electronic Address for the Company Formation in Serbia

- Founding Capital of the Company in Serbia

- Articles of Incorporation (Founding Act) for the Company Formation in Serbia

- Online Company Registration in Serbia before Serbian Business Registers Agency

- Obtaining an Electronic Certificate and Registering the Company’s Beneficial Owners

- Opening a Bank Account for the Company

- Choosing an Accountant, Submitting Tax Returns, and Corporate Taxation as a Final Step of Company Formation in Serbia

- Temporary Residence and Work Permits in Serbia for Entrepreneurs, Company Founders, Company Directors, and Employees

- Obtaining a Schengen (EU) Visa and Making Use of Serbia’s Bilateral Agreements following Company Formation in Serbia

Legal Forms in Serbia and Their Differences – First Step in Company Formation in Serbia

When starting a business in Serbia, you must make the crucial decision of choosing the legal form for your company. The most common business structures in Serbia are sole proprietorship (PR) and LLC ( DOO). On the other hand, many foreign companies opt to open their branches or representative offices in Serbia. Furthermore, there are also less frequently used forms such as partnerships, limited partnerships, and joint-stock companies. Each legal form has its specific features and benefits.

Therefore, choosing the right legal form for your company in Serbia is a critical decision. Here are the main types of business entities and their characteristics:

| Legal Form | Characteristics |

| Sole Proprietorship in Serbia (PR) | A sole proprietorship and its founder are the same entity, meaning there is no separate legal personality. This implies that the rights and obligations of the sole proprietor and their founder are identical – the sole proprietor is liable with both personal and business assets. This is an ideal structure for smaller business ventures. Sole proprietors most commonly choose between a flat monthly tax and double-entry bookkeeping. |

| Limited Liability Company – LLC in Serbia (DOO) | A limited liability company (DOO) is the most popular form for businesses of all sizes, established by one or more founders – individuals or legal entities (companies). The main advantage of a DOO is the limited liability of the founders/owners of the company. This means that company shareholders risk only what they have invested in the company. The company itself, not the owners, is responsible for its obligations. In other words, this structure separates founders’ personal assets from the company’s assets. LLC is the safest and most commonly used business structure in Serbia. |

| Branch of a Foreign Company in Serbia | A Branch of a Foreign Company in Serbia allows foreign companies to operate in Serbia without establishing a company in Serbia. It is an organizational part of the foreign company operating in Serbia. Such a Branch Office operates under the same legal identity as its parent company. * Banking regulations consider branches as residents and allow them to open resident bank accounts. For this reason, and because of some interesting tax benefits, foreign companies often register their branch in Serbia. |

| Representative Office of a Foreign Company in Serbia | A Representative Office represents a non-commercial presence of foreign companies in the Serbian market. The Representative Office serves as an organizational unit of the foreign company. It conducts preliminary and preparatory activities aimed at concluding business transactions for the parent company. *Neither branches nor representative offices have separate legal personalities, which makes the parent foreign company liable for their obligations. |

The most commonly used and suitable forms for company formation in Serbia are: sole proprietorship (PR) and LLC (DOO). These two business entity forms are ideal for businesses of all sizes, including micro, small, medium, and large enterprises. Therefore, we will focus on PR and LLC as they provide the flexibility and benefits that cater to various business needs.

How Long Does It Take to Register a Company in Serbia?

Registering a company in Serbia, including the preparation and acquisition of necessary documents, typically takes between 5 – 15 days. The time needed for the registration of a company in Serbia depends on the efficiency of all parties involved. Registering a company in Serbia through the Business Registers Agency (BRA) with the help of a lawyer can be a quick, simple, and legally reliable way to start your business in Serbia.

A lawyer in Serbia has the authority to submit all documentation and certify documents with their electronic signature. This streamlined process makes the registration of a company or a sole proprietorship significantly faster when done through a lawyer. Therefore, engaging a lawyer can make the company formation in Serbia a fast and reliable process!

Choosing a Business Name Before Company Formation in Serbia

Selecting a business name of a company is a crucial step when registering a company in Serbia. While a sole proprietor operates under their personal name, an LLC (DOO) must have an official company name.

The business name of the Serbian company should be unique and distinguishable from existing company names in Serbia. To appeal to international clients, the company name can also be registered in foreign languages. A typical business name for the Serbian LLC includes three components: 1) the name itself (e.g., “Firmly”), 2) the legal form (“DOO”), and 3) the location of the company headquarters (e.g., “Belgrade”). Therefore, the typical business name of a Serbian company looks like this: “Firmly DOO Belgrade.” Alternatively, the companies in Serbia can register abbreviated names, which look like: “Firmly DOO” or “Firmly doo”.

The Business Registers Agency (BRA) checks name availability to ensure that your desired company name is not already in use or too similar to existing names. This is a vital step, as registering a company name that is identical or very similar to an existing one is not permitted. Upon request, the BRA checks name availability and reserves your desired name for 60 days. However, you can also perform an informal search for free on the BRA’s website.

Following the reservation of the business name, you may proceed to other important steps of company registration in Serbia.

Defining the Business Activity for the Company Formation in Serbia

When you establish a company in Serbia, you must select a primary business activity and specify a code and business activity name. The business activity of the Serbian company is outlined in the company’s Articles of Incorporation (Founding Act of the Company). However, this does not limit your company to only that activity! Serbian legislation requires you to register one primary business activity for the company, but you can also engage in additional activities.

This flexibility distinguishes Serbian regulations from those of many other countries. You can choose a main business activity of the company to present to your clients, but you are free to undertake additional or different activities, as long as these do not require special permits or licenses (such as in the banking or healthcare sector).

In essence, while the registration of your business activity is a formal requirement for the company formation in Serbia, it does not restrict the scope of your company’s operations. For a comprehensive list of business activities, refer to the Decree on Classification of Activities, or NACE codes. Additionally, professionals such as lawyers can provide valuable assistance in selecting the appropriate activity code for your company.

After you choose the business activity code, you can address other important elements of company formation in Serbia.

Management and Ownership Structure for Company Formation in Serbia

Can Foreigners Be Founders and Directors of a Serbian Company?

Yes! You can have foreigners as founders and directors of companies in Serbia! For a sole proprietorship, the founder and legal representative are the same person—the sole proprietor.

For a limited liability company (DOO), both domestic and foreign nationals can serve as founders and legal representatives. The company must appoint at least one director, who will act as the primary legal representative. In addition to the director, a company can appoint other representatives, such as additional representatives or procurators.

The company’s director manages day-to-day operations, signs corporate documents, oversees employees, implements decisions made by the company’s founders or owners, and represents the company in dealings with third parties.

The company founder(s) collectively form the company’s general assembly, which is responsible for making major decisions about the company’s operations, including appointing directors, amending the Articles of Incorporation (Founding Act of the Company), and other critical decisions.

In addition to the director, the company can appoint other registered representatives or procurators – business proxies authorized to conduct legal transactions and perform other actions for the company. Furthermore, the company founders can also establish additional management bodies, such as a supervisory board.

Do I Need to Have at Least One Director, Representative, or Founder Who Is a Domestic Citizen for Company Formation in Serbia?

In short—No! You do not need any Serbian nationals in your company’s structure, neither for the company formation in Serbia nor for its ongoing operation.

In Serbia, both domestic and foreign company founders and directors have equal rights. As a result, foreigners can fully establish a company and act as representatives of a Serbian company. In other words, your Serbian company does not require Serbian citizens to be representatives or founders at any time.

Do I Have to Employ a Director of the Company, or Is There an Alternative Option?

You have two excellent options for engaging a company director for the company formation in Serbia:

- Employment Agreement: This option creates a formal employment relationship between you and the director, including all related rights and obligations. This includes compliance with minimum wage regulations, sick leave, vacation, and other employment benefits.

- Director Agreement: This alternative agreement outlines the director’s rights and obligations without creating an employment relationship with the company director. It offers several benefits, such as exemption from minimum wage laws and employment rights. This option can be particularly advantageous for foreign directors who do not intend to reside permanently in Serbia.

You can select the option that best suits your business needs and goals, allowing you to engage company directors in a way that aligns with your company’s objectives.

Can I Restrict the Authority of the Director to Represent the Company?

Yes, you can! You can limit the authority of company representatives under Serbian Company Law.

You can restrict their authority regarding specific legal transactions, transaction values, or by requiring mandatory co-signatures.

Furthermore, you can define and restrict the authority of the company’s representatives during company formation in Serbia and at any later point. Therefore, your company in Serbia is a structure that can be constantly changed and adapted!

Company Headquarters and Electronic Address for the Company Formation in Serbia

When you establish a company in Serbia, you must have both a registered company headquarters and an electronic address (email) for correspondence. The company headquarters is the official address where your company is legally registered. All formal communications with authorities and your partners will go to this address. Also, you can change the company’s address anytime after establishing the company in Serbia.

Also, in Serbia, you have the option to use virtual office services, which can offer cost-effective solutions for your company’s headquarters. However, it is crucial to consult with legal professionals to understand and address any potential risks associated with this arrangement. With proper legal and corporate documentation, you can manage virtual headquarters effectively and legally.

Additionally, companies in Serbia may choose to register a separate mailing address if you prefer that correspondence be sent to a location different from your registered business headquarters. This can be particularly useful for privacy or operational reasons.

Furthermore, companies in Serbia can also establish branch offices as distinct organizational units with their own addresses. This is common for businesses with multiple locations, such as pharmacy chains, retail outlets, or restaurant franchises. Additionally, domestic companies can assign separate representatives to their branch offices, distinct from those of the parent company. Branch offices of Serbian companies offer flexibility in managing various business activities, in multiple locations.

These options provide diverse and adaptable solutions for setting up and managing your business operations in Serbia, allowing you to tailor your business presence to your specific needs.

Founding Capital of the Company in Serbia

A limited liability company in Serbia (DOO) requires a defined amount of founding capital for the company formation. For an LLC in Serbia (DOO), the minimum founding capital is set at 100 Serbian dinars (approximately 1 USD), and while it is expressed in dinars, payment can also be made in any foreign currency. The founding capital of the company serves as the initial funding to cover startup costs such as registration, equipment, and inventory of the newly established company.

Although the required founding capital is relatively low, you are free to specify a higher amount if necessary for a successful company formation in Serbia.

In contrast, when establishing a sole proprietorship in Serbia, there is no requirement for a specific amount of founding capital. As the sole proprietor is legally considered the business entity, their personal funds are used as the founding capital.

Can I Contribute Non-Monetary Assets as Founding Capital?

Absolutely!

Non-monetary assets can be contributed as company’s founding capital. This includes intellectual property, software, real estate, equipment, and other assets. The valuation of these non-monetary contributions is typically done by the founders or an authorized appraiser.

Is Immediate Payment of Founding Capital Required?

No, immediate payment of the company’s founding capital is not required.

At the time of company establishment, you only need to register the founding capital amount. Serbian Law allows for the founding capital to be paid or contributed within five years of the company’s establishment, giving you the flexibility to focus on setting up your business initially.

Articles of Incorporation (Founding Act) for the Company Formation in Serbia

Sole proprietors in Serbia do not have to create any founding act to register their sole proprietorship. However, for a limited liability company (LLC), the company must include the Articles of Incorporation (founding act) as a mandatory corporate document for the company formation in Serbia.

Articles of Incorporation is the primary document that defines the structure and manner of operation of the company in DOO (LLC). This document must be drafted in full compliance with the Serbian Companies Law, in written or electronic form. Since 2023, a lawyer with an electronic certificate can sign the Articles of Incorporation electronically. Engaging a lawyer in Serbia can reduce the costs of notary certification for the Articles of Incorporation..

Key Elements to Include in the Articles of Incorporation

- Information about the company’s founders.

- The business name and headquarters of the company.

- The primary business activity of the company.

- The total amount of company’s initial capital.

- Details of monetary contributions and descriptions of non-monetary contributions from the founders.

- The schedule for payment or introduction of contributions into the company’s capital.

- The percentage share of each founder in the company’s total initial capital.

- The designation of the company’s bodies and their respective competencies, etc.

In addition to the essential details, the Companies Law allows founders to regulate many company relationships and address various events that might affect the company. Additionally, changes to the Articles of Incorporation can be made after the company formation in Serbia is finished.

Shareholders’ Agreement

Alongside the Articles of Incorporation, founders may also execute a Shareholders’ Agreement to address internal company matters more precisely. This private document can cover areas such as decision-making processes, inheritance issues, profit distribution rules, and preemptive rights. Unlike the Articles of Incorporation, the Shareholders’ Agreement is not published in the Business Registers Agency online registry and is not a necessary document for company formation in Serbia.

Legal Considerations

The Companies Law sets default rules that apply if the Articles of Incorporation does not specify otherwise. To ensure accurate legal interpretation and proper documentation, consulting with legal experts is essential.

Lawyers in Serbia are uniquely qualified to provide legal assistance and representation in Serbia. Consequently, by engaging a lawyer you may ensure your company’s founding documents comply with legal requirements and serve your business needs effectively in the future.

Online Company Registration in Serbia before Serbian Business Registers Agency

Company registration in Serbia is conducted electronically through the Business Registers Agency (BRA) portal. This process is streamlined, efficient, and designed for rapid execution. Therefore, once all documentation is prepared and submitted, BRA issues the decision on company registration in Serbia within five working days.

How Does Electronic Company Registration in Serbia Work?

Electronic company registration in Serbia involves several steps facilitated by your lawyer:

1. Document Preparation

- For Serbian founders, a scan of an ID card is required.

- For foreign founders, a passport scan (if natural person) or a certified and translated excerpt from the business registry of a foreign company is necessary (if legal entity).

- A special power of attorney authorizing your lawyer to act on your behalf before BRA.

2. Submission and Certification

- Your lawyer will certify previously prepared documentation (Articles of Incorporation and the above mentioned documents) and submit it electronically to BRA.

- This means you do not need to be physically present in the country for company registration in Serbia – everything can be handled remotely.

For sole proprietors, registration is even more expedited as it does not require a founding act. Nevertheless, forming an LLC in Serbia is quite straightforward, thanks to the online process and the comprehensive information provided in the articles of incorporation.

Furthermore, once your Serbian company is registered, you can proceed to the subsequent steps relevant to the completion of the company formation in Serbia, which will be discussed in the following sections.

Obtaining an Electronic Certificate and Registering the Company’s Beneficial Owners

Following the company registration in Serbia, you will need a Serbian electronic certificate. An electronic certificate is essential for secure electronic communication with Serbian authorities. Following the registration of your company in Serbia you must obtain an electronic certificate the company’s director. Your lawyer can also facilitate this process.

Why Do You Need an Electronic Certificate?

- For Entrepreneurs: You need the electronic certificate to access the ePorezi (eTaxes) platform, where you will receive annual tax decisions and instructions for paying monthly taxes.

- For LLC Directors: The company director needs the certificate to register the company’s beneficial (ultimate) owners in the Central Register of Beneficial Owners maintained by BRA.

Timing and Registration

It is crucial to obtain the electronic certificate promptly after the company’s formation. The registration of beneficial owners must be completed within 30 days of the company’s registration. Once the certificate is issued, your lawyer can assist with the electronic registration of the beneficial owners, ensuring compliance with all legal requirements.

Opening a Bank Account for the Company

After registering your company, the next critical step for company formation in Serbia is to open a business bank account in Serbia. In Serbia, there is a wide range of domestic and international banks to choose from, each offering various services, including account management, loans, and additional financial products.

Basic Documentation for Opening a Bank Account:

- Signed KDP Form: Signature card for the bank.

- OP Form: Signature of the company director for bank communications.

- Identification: Passport or ID card scan of company directors and owners.

- Statement on the Status of Officials: Confirmation of the director’s and founders’ status.

- Ownership Statement: Company director’s declaration regarding the company’s ownership structure.

- Account Agreements: Signed agreements for both dinar and foreign currency accounts.

All banks in Serbia provide electronic and mobile banking services and offer customer support in English. Therefore, you can manage your company’s financial transactions remotely.

Bank Account Opening Assistance for the Company, Directors and Employees

A lawyer can represent you during the bank account opening process in Serbia, potentially eliminate the need for your physical presence through a power of attorney.

Choosing an Accountant, Submitting Tax Returns, and Corporate Taxation as a Final Step of Company Formation in Serbia

Choosing an Accountant and Submitting Tax Returns

Entrepreneurs starting as lump sum taxpayers must maintain a “KPO book” (book of turnover) to record their income from business activities. If your turnover exceeds six million dinars (approx. EUR 50,000) within a calendar year, you will have to switch to double-entry bookkeeping, similar to LLCs. This limit resets at the beginning of each new business year. Until this threshold is reached, entrepreneurs only need to keep the KPO book—either in paper or electronic format (e.g., Excel)—and pay the monthly lump sum for taxes and contributions. You can use the Tax Authority’s calculator to determine the correct amount.

The LLC in Serbia (DOO) must complete additional steps beyond company registration in Serbia with the Business Registers Agency (BRA). Specifically, LLCs must submit their tax returns within 15 days after they register. Thus, selecting a reliable accountant or accounting agency is crucial for managing bookkeeping and tax submissions effectively.

Corporate Taxation of Serbian Companies

In Serbia, annual corporate profit tax is levied at a competitive rate of 15%, one of the lowest in the region, Europe, and globally[1]. Moreover, this various tax reliefs and recognized (even double) business expenses accompany this tax rate for Serbian companies.

For entrepreneurs who maintain business books (non-lump sum entrepreneurs), there are notable differences compared to LLCs:

- Entrepreneurs’ annual profit is taxed at a lower rate of 10%;

- Entrepreneurs must pay themselves a monthly personal salary.

A lawyer can help you understand and choose the right tax framework and address other tax issues related to your business, including matters such as applicability of value-added tax (VAT) regulation to your business.

Temporary Residence and Work Permits in Serbia for Entrepreneurs, Company Founders, Company Directors, and Employees

After you successfully complete the company formation in Serbia, you may want to settle and live in Serbia. Foreign founders and legal representatives of companies in Serbia can apply for temporary residence and work permits based on their roles in the company. This includes:

- Company Founders: Can apply for residence based on the employment in the company they incorporated.

- Company Directors: Can apply for residence and work permits based on their engagement in the company.

- Entrepreneurs: As they are both the employer and employee, they can apply for permits based on self-employment.

Application Process and Benefits

Residence and work permits in Serbia are processed electronically. This process allows you to submit applications and receive a unified residence and work permit without needing to be physically present. Initially, the permit is issued for up to three years. After three years of temporary residence, you may be eligible to apply for permanent residence.

The unified residence and work permit grants:

- Legal residence in Serbia

- The ability to open personal bank accounts

- Receipt of a salary

- Access to health and social insurance

- Other rights and benefits within Serbia

The company can also help its employees obtain residence and work permits. If an employee loses their job, they can transition to a different basis for staying in Serbia by establishing a sole proprietorship in Serbia. This could also allow them to continue residing and working in the country under a new status.

This streamlined online process simplifies the establishment of your business and legal stay in Serbia, ensuring that you can focus on growing your enterprise. Finally, it is important to note that you can apply for a temporary residence and work permit only after completing the company formation in Serbia.

*You can find everything you need to know about temporary and permanent residence in Serbia in our blog post – Residence in Serbia for Foreigners Simplified !

Obtaining a Schengen (EU) Visa and Making Use of Serbia’s Bilateral Agreements following Company Formation in Serbia

Foreign citizens with temporary or permanent residence in Serbia can apply for a Schengen (EU) visa at the embassies of EU member states in Serbia. This visa allows you to travel within the Schengen Area and other countries as long as you hold legal residence in Serbia.

Also, doing business in Serbia presents numerous advantages: Serbia is a formal candidate for EU membership and is strategically located in the heart of Europe. Also, Serbia has established free trade agreements with major global economies, including China and Russia. Serbia participates in the Open Balkan initiative alongside Albania and North Macedonia. Additionally, Serbia has signed 68 bilateral agreements to avoid double taxation with various European and other countries[2].

Establishing a company in Serbia can be a straightforward and efficient process if you adhere to the steps outlined in this guide. Therefore, to ensure compliance with all legal requirements and to navigate the Serbian company formation process smoothly, obtaining legal advice and assistance from an experienced market entry lawyer is highly recommended.

We hope that this brief guide to starting a business in Serbia has helped you better understand the process and timelines for company formation in Serbia. Also, we hope that you now understand your options for appointing company directors, residence and work permits for directors and company founders.

Finally, we hope that you are now ready to confidently embark on your business venture in Serbia!

If you still have questions or want to dive deeper into the topic, we invite you to read our blog post featuring the Top 50 frequently asked questions about company formation and doing business in Serbia!

Interested in the benefits of Company Registration in Serbia? Read our blog post on – 10 Reasons to Register a Company in Serbia!

[1] OECD website – Statistical overview of data: https://data-explorer.oecd.org/vis?tenant=archive&df[ds]=DisseminateArchiveDMZ&df[id]=DF_TABLE_II1&df[ag]=OECD&dq=.&lom=LASTNPERIODS&lo=5&to[TIME_PERIOD]=false&vw=tb

[2] Website of the Serbian Ministry of Finance – The list of Double Taxation Treaties: https://www.mfin.gov.rs/sr/propisi-1/ugovori-o-izbegavanju-dvostrukog-oporezivanja-1